Staatsolie Hydrocarbon Institute N.V. (SHI) holds the regulatory role with respect to the petroleum industry.In this role Staatsolie Maatschappij Suriname N.V. (Staatsolie) supervises the Petroleum Operations of the Oil and Gas companies in Suriname, in order to maximize the value of hydrocarbon resources in our basin.

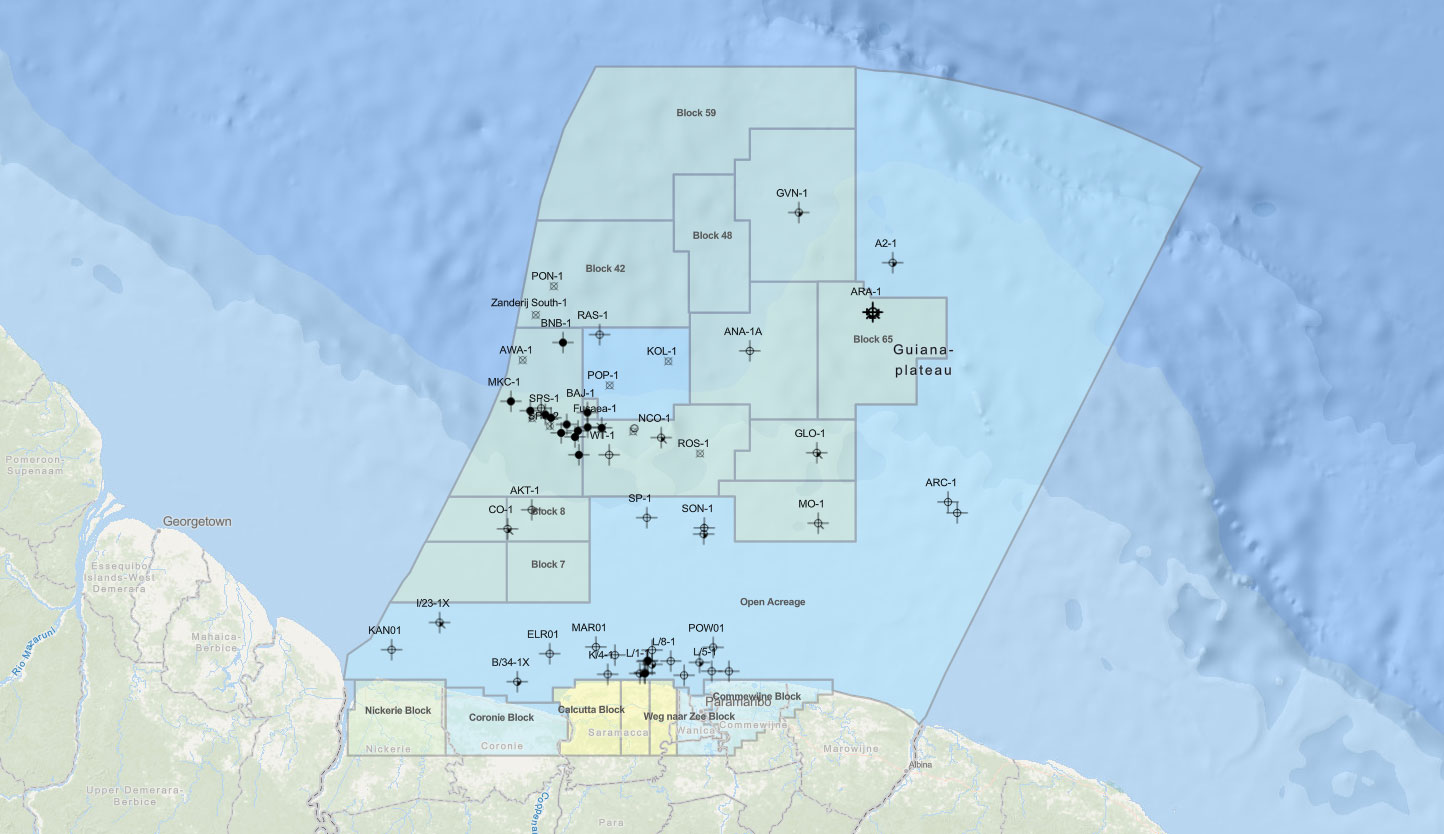

Suriname’s hydrocarbon resources are being explored and developed through partnerships facilitated by SHI with experienced international oil companies. As of June 2024, there are 14 active Production Sharing Contracts in both offshore and onshore areas of Suriname.

Check out our interactive map below to see a visual overview of these contracts and the operators in each block. Click on a block for more details.

For the interactive map, please view on larger screen.

Exploring and developing Suriname's hydrocarbon resources requires a comprehensive understanding of the legislative framework, geological landscape, and available data. Staatsolie Hydrocarbon Institute (SHI) plays a crucial role in managing and protecting all petroleum data, evaluating the basin’s potential, and overseeing the execution of petroleum agreements. To delve deeper into these aspects, explore the following sections on legislation, geology, and data.

Staatsolie focuses on local content as much as possible to support Suriname’s economy. This means not only using local businesses and hiring Surinamese talent but also encouraging international oil companies to do the same. By keeping these activities within the country, we help create jobs, support local businesses, and contribute to community development.

As Suriname's petroleum regulator, Staatsolie Hydrocarbon Institute N.V. (SHI) is dedicated to ensuring that oil companies not only invest wisely but also give back to our community, as promised in their agreements.

If you want to offer goods and services to the Surinamese offshore oil and gas industry, please register your business on the Supplier Registration Portal.

Since its founding on December 13, 1980, Staatsolie has paid more than US$ 4 billion in taxes and dividends to the State. Staatsolie's added value to the Surinamese economy is a multiple of this amount.

A concrete example: In 2023, the contribution to the state treasury was US$ 335 million. That is over thirty percent of the US$ 1 billion in government revenue in 2023. The 2023 annual report and those of recent years can be consulted on the Staatsolie website.

Staatsolie significantly contributes to employment in Suriname with approximately 1,150 direct jobs and many more indirect jobs.

Staatsolie's contribution to the community is significant. Between 2021 and 2023, about US$ 5 million was invested in various social and community projects. See also the sustainability reports of 2022 and 2023.

Thus, Staatsolie makes a substantial contribution to Suriname's development. However, the economic development of small open economies like Suriname's is not solely dependent on natural resources. Factors such as productivity, institutional capacity, human resources, and fiscal discipline are also decisive.

All PSCs are and will be concluded based on and in accordance with the Petroleum Law of Suriname. Under the 1986 Mining Decree, concession rights for petroleum activities are exclusively granted to state companies, in this case, Staatsolie. According to the Petroleum Law (Official Gazette 1991, No. 7, and the Amendment of the Petroleum Law 1990), Staatsolie is authorized to enter into petroleum agreements with qualified petroleum companies after government approval.

The terms for Suriname are favorable with a 6.25% royalty, profit oil distribution, and 36% income tax, resulting in a share for Suriname of 60-70% (after costs), depending on the oil price. Suriname's favorable position has also been confirmed through benchmarking with PSCs from other countries such as Guyana, Brazil, and Angola.